The Possibility and Potential of Wealth 3.0 💰

It’s hard to imagine a world where our clients do not care about the well-being of themselves and their family members.

Discussing the future, Jeff Bezos stated, "It’s impossible to imagine a world where Amazon customers don’t want low prices and fast shipping," allowing him to invest enormous resources into these areas.

This quote, highlighted in Morgan Housel's book, 'Same as Ever.' Bezos presents a mental model for long-term thinking that's applicable to both life and business. He encourages us to shift our focus from what changes to what we are fairly certain will remain constant. When we discuss this concept with family office leaders, their insights reveal a great deal.

It’s hard to imagine a world where our clients do not care about the well-being of themselves and their family members. 🩷

In fact, those firms have already begun to capitalize by pouring time and resources into this growing idea: defining wealth as well-being and a flourishing family, not merely as financial assets. Some firms dismiss well-being as 'the soft stuff' or 'not our concern,' and time will tell how those stances fare, but the shift is underway.

Web 3.0 describes the internet's move towards decentralization. Medicine 3.0 refers to a more personalized, preventative approach to health and healthcare. Wealth 3.0: The Future of Family Wealth Advising, published in 2023 by authors and experts Grubman, Keffler, and Jaffe, provides a wonderful explanation of how the industry got here and where it's headed. If you serve or aspire to serve high-net-worth (HNW) or ultra-high-net-worth (UHNW) clients, or if you are a HNW client wondering whether you're currently working with a Wealth 3.0 firm, this book is essential reading.

What Wealth 3.0 adds is a full emphasis that, as the field envisioned over 25 years ago, the many nonfinancial domains of the family are as or more important than the financial arena.

It's surprising how many financial professionals are unaware of the 5 Forms of Family Capital or the 10 Domains of Family Wealth. Like most things, these concepts originate with the ultra-wealthy, eventually reaching a broader audience. TFM's mention in Wealth 3.0 is an honor, showcasing the growing collaborative and client-focused approaches in wealth management. Below is a summary of Wealth 1.0 to 3.0 and questions to consider, but this topic is too important to trust my CliffsNotes. Read and decide for yourself.

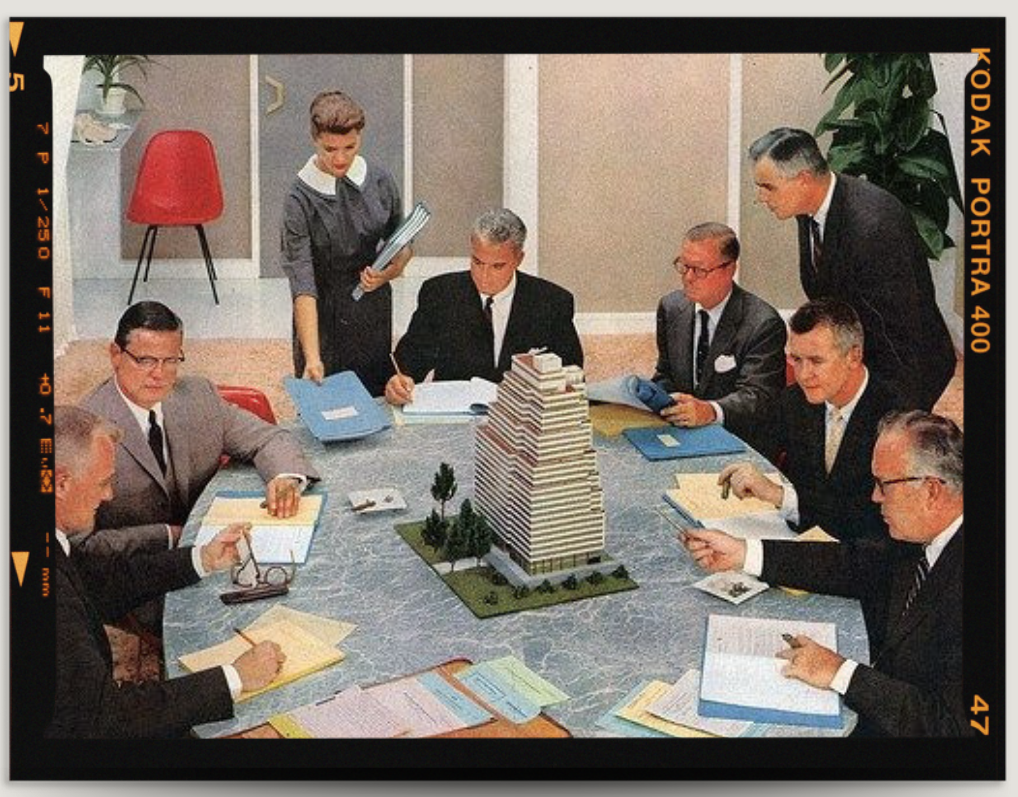

Wealth 1.0 💵

- "Yet throughout Wealth 1.0, estate planning was and is only about the money, its preservation, and its protection from governmental interference and taxation."

- Little consideration of family dynamics, communication, parenting, preparation. “That’s not our concern.” (Which I have heard from way more financial advisors than I care to remember.)

- Firm’s primary relationship with the ‘Patriarch,’ little to no consideration for the non-CFO spouse (largely female) or rising generation.

Questions for Firm Leaders:

- How does my firm's approach reflect or diverge from Wealth 1.0?

- What % of our advisors are 'financial managers' vs. 'wealth managers?'

Wealth 2.0 🙈

- When clients say, “I don’t want this money to ruin my kids,” advisors nod.

- Negative, fear-based messages: shirtsleeves to shirtsleeves, wealth destroys families as ‘true stories’ that ‘can and will happen to you.’

- Referring to the ‘rising generation’ as ‘next generation.’ Advising clients to delay communication about wealth and estate planning or not telling them at all.

- Using philanthropy as a forced way to build harmony; lack of customized solutions specific to the client.

- Single advisor who ‘owns’ the relationship and defends their turf.

Questions for Firm Leaders:

- Do my firm use negative or fear-based (shirtsleeves) messaging on your website or marketing materials?

- Do our clients have a stronger connection to our firm or their advisor?

- How can we better engage the rising generation in wealth and legacy planning?

Wealth 3.0 🍎

- Wealth as Well-Being; human, social, cultural (spiritual), and intellectual capitals, not just financial.

- Strength-based approach; focus on opportunities and possibilities; Family Vision.

- Aligned with the 10 Domains of Family Wealth.

- Collaborative, integrated, cross-domain advisors working with more members of the family; open communication and respect.

- Democratization of family-dynamics and governance services; scale + technology

Questions for Firm Leaders:

- How can we integrate the 5 Forms of Family Capital and well-being into our services?

- What actions can we take to promote a more integrated and collaborative approach?

- How can we align our services with clients' unique family visions?

This is not an overnight change, and shifting the mindset of one advisor is drastically different than shifting the culture of a firm. The good news is a tenet of Wealth 3.0 is collaboration; integration of cross-domain resources and experts with communication and respect. In addition to the questions, here’s some additional resources: